The Chinese traveller in a post-COVID-19 world

Contributed by Renee Hartmann, Co-founder at China Luxury Advisors

As the global tourism industry limps into a hesitant local and regional rebound with the onset of Summer, tourism destinations are anxious for the return of international travellers during the second half of 2020.

China has long provided the world’s most lucrative travelling consumers, having eclipsed Americans, Japanese and Germans years ago in terms of global tourism spending.

To help destinations plan for some semblance of a return to ‘normal’ Chinese tourism, we have posed some key questions based on our ongoing tracking of Chinese consumer sentiment in the wake of the coronavirus.

When will Chinese tourists return to international travel?

This one is hard to predict and will ultimately depend on the global progression of COVID-19. Currently, Chinese tourists are travelling within China, and we expect this will continue at least through the summer and likely into fall/winter 2020. We expect that destinations in Asia will rebound first, in lockstep with government policies regarding post-travel quarantine.

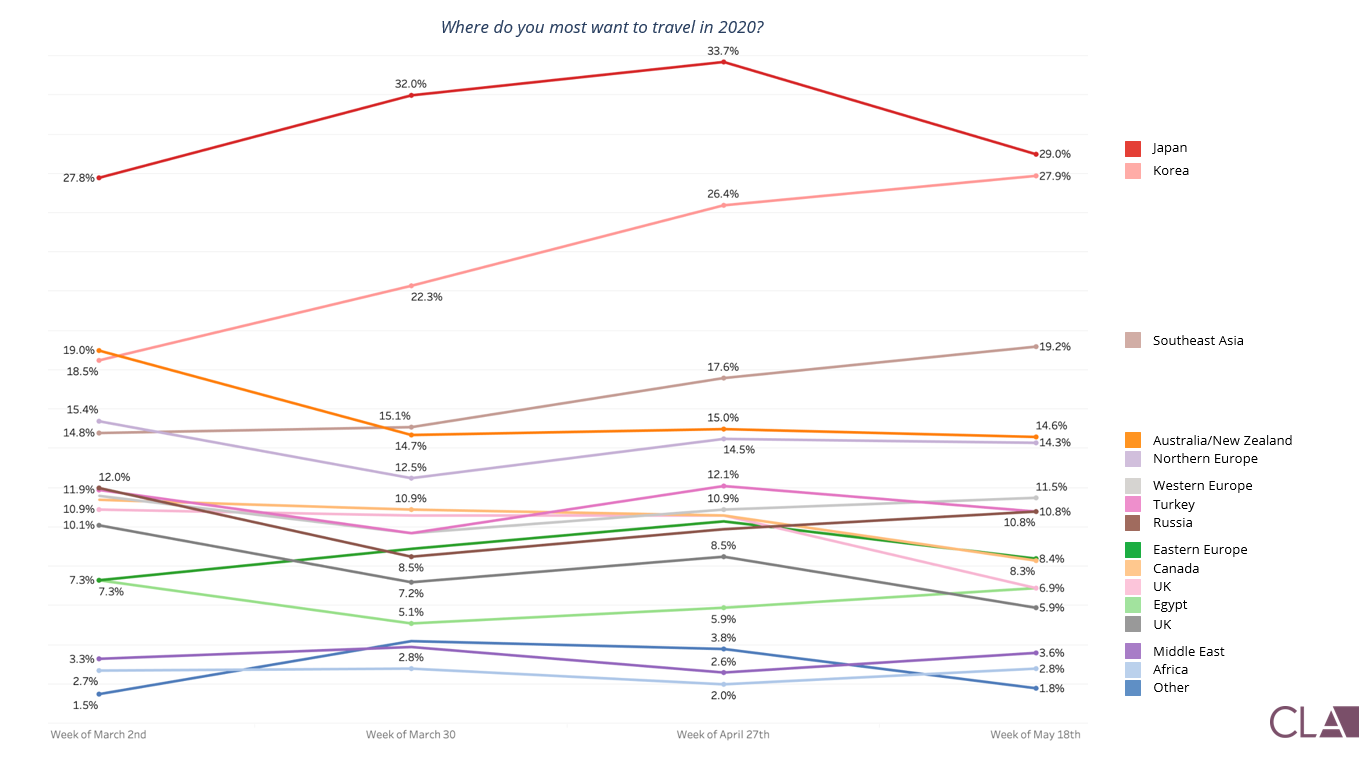

Where do Chinese tourists want to travel?

CLA asked more than 5,000 Chinese citizens where they wish to travel. Asian destinations topped the list, with Oceania and Western Europe following close behind.

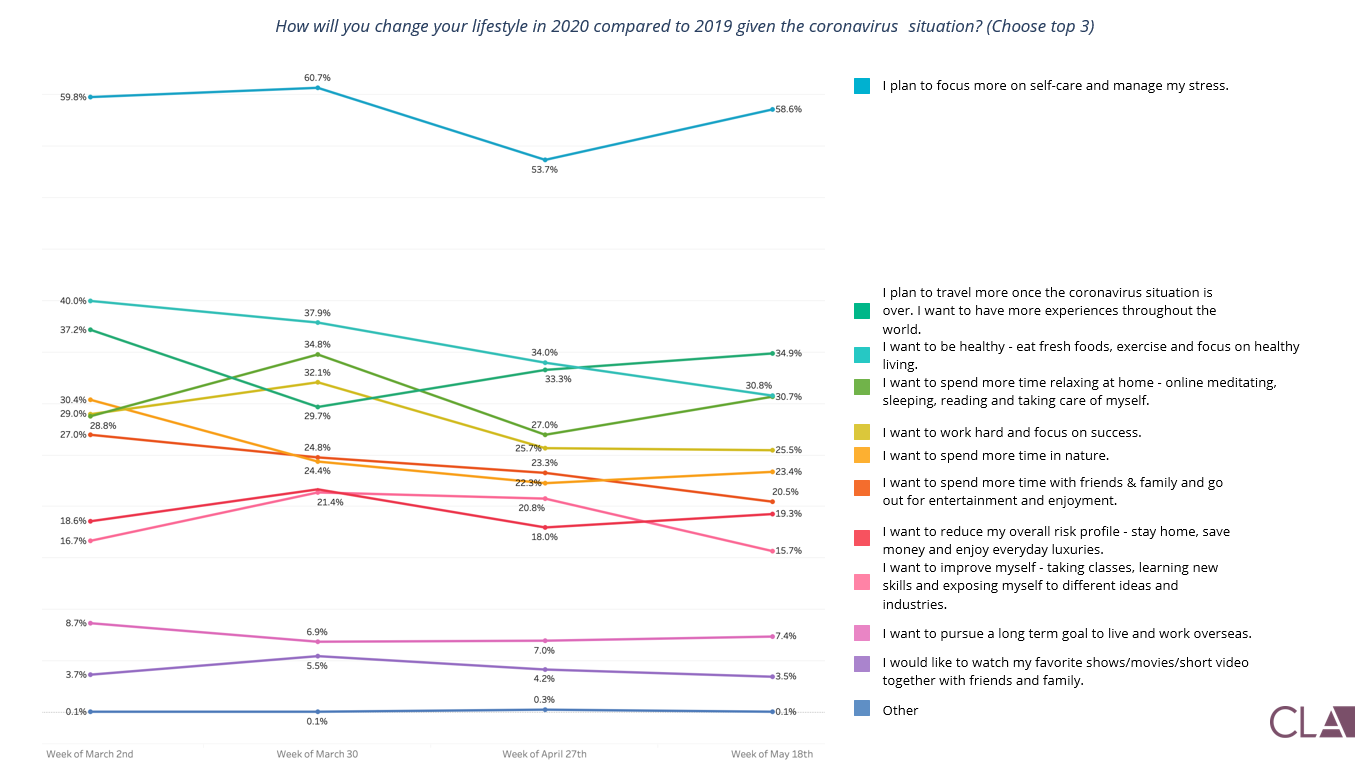

How has COVID-19 changed the Chinese consumer’s lifestyle choices and goals?

The prevailing sentiment is that Chinese consumers are increasingly focused on self-care and stress reduction - though we have seen this ebb and flow as time passes. Other factors that are important post-COVID-19 are creating a healthy lifestyle, creating a home sanctuary and spending time in nature.

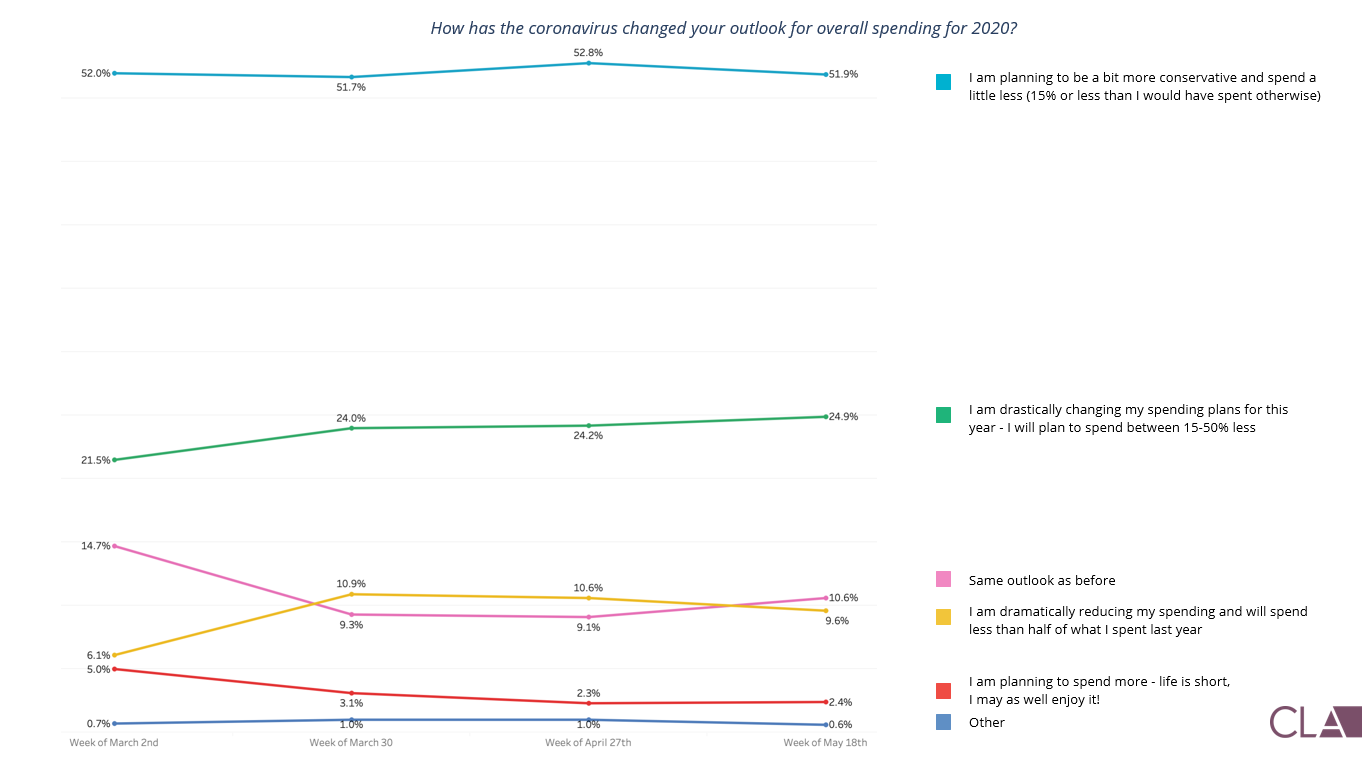

How have Chinese consumers changed their spending in 2020?

A majority of consumers are planning to be a bit more conservative in their spending this year, estimating that they will spend about 15% less than they would have otherwise, and about 25% are planning to drastically reduce their spending by up to 50% of what they would have spent in 2020.

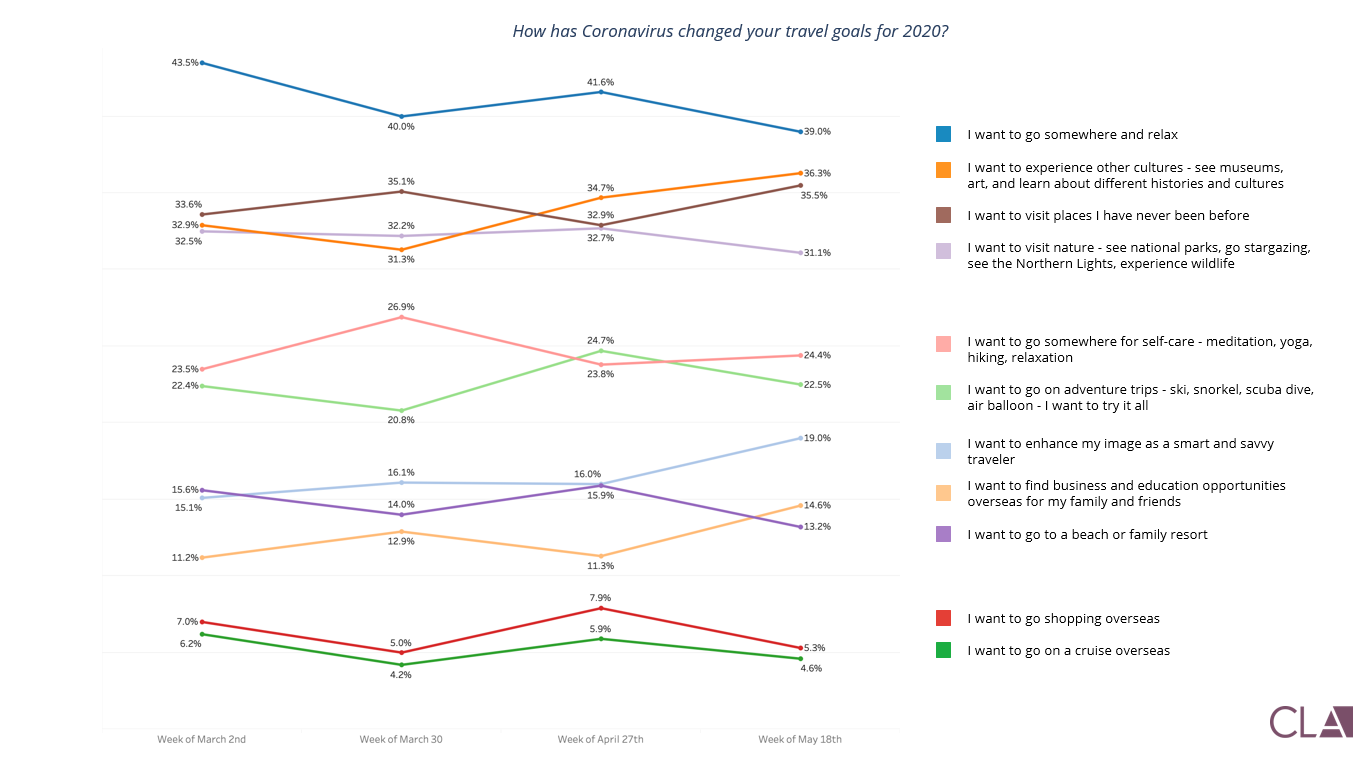

How have Chinese tourists adjusted their goals for choosing a destination as a result of COVID-19?

Immediately following the COVID-19 lockdown in China, Chinese travellers were desperately dreaming of escaping to a place to relax and unwind. The longer that China was out of the lockdown and life largely returned to normal, the more we saw a trend towards wishing for adventure, exploration and cultural destinations.

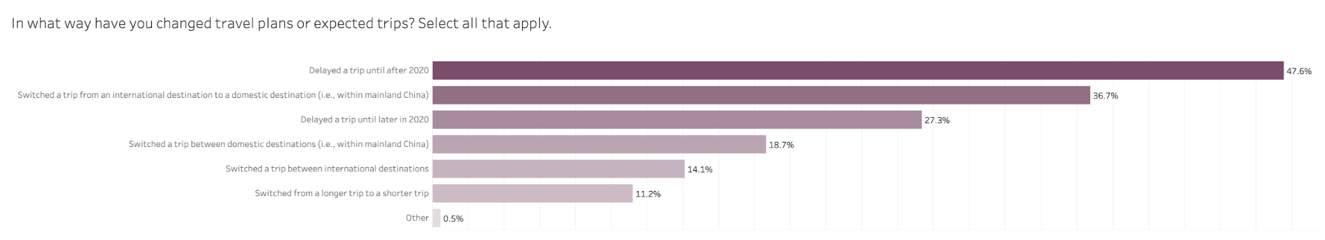

In what ways have Chinese tourists altered their travel plans for 2020?

A majority have simply delayed their trip until later this year or after 2020, while others have opted to adjust their plans to visit a domestic destination this year to hot spots in China such as Hainan Island, Sichuan and even to Wuhan where Chinese citizens can support the city that was hardest hit by COVID-19.

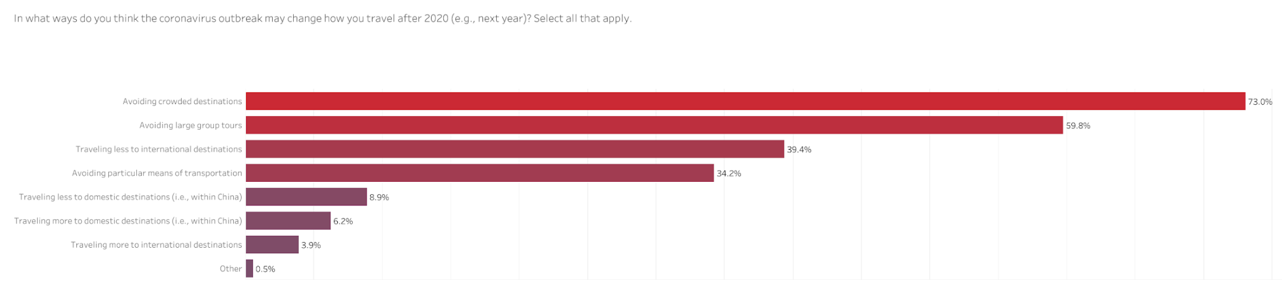

How will Chinese travellers adapt their travel choices once they travel again?

A majority of respondents will seek to avoid crowded destinations - both during travel and at the destination. They also said that they will avoid group tours - which has long been a trend in the Chinese traveller market and one that we expect will accelerate even more post COVID-19.

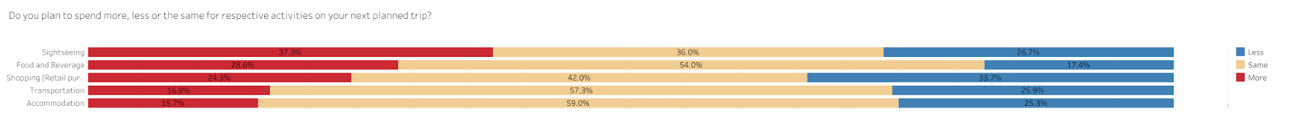

How will Chinese tourists adjust their spending during the trip once they travel?

Chinese travellers are planning to spend more on sightseeing and food and beverage, and less on shopping. For accommodations, we see a majority (59%) planning to spend the same on accommodations, and some spending more (15%) and some spending less (25%).

CLA recommends the following solutions that destinations and DMOs can engage as they look toward the rebound of Chinese travellers:

1. Seed Travel Inspiration Now

Now is a great time to engage Chinese travellers and inspire their travel dreaming and planning. With international travel difficult to undertake, we recommend finding Chinese influencers who live in your country to visit destinations in a post COVID-19 manner and showcase their experience via their social networks. Destinations and DMOs can amplify this content via Chinese social and media channels to connect with Chinese consumers who are stuck at home.

2. Create Technology Support and Resources

This is a great time for destinations to invest in technology resources to support Chinese travel. We are seeing DMOs and destinations alike create WeChat mini programs to both connect with the travel trade and engage Chinese consumers with virtual experiences, advance purchase items and create pre-purchase and pick up options for when travel rebounds.

3. Assess Your Destination From a Chinese Traveller’s Point of View

Research how Chinese consumers view your destination and use this information to communicate to them about how your destination and their favourite attractions have responded to COVID-19 and how you will keep them safe when they are able to travel.

Related reading

The politics of space, culture and placemaking in a post-COVID world

Hall of Fame: 15 of the best place marketing and place branding campaigns